Loanable Funds Market Graph Crowding Out. What happened to the nominal interest rate in this market? Businesses it makes the purchases of capital goods, expanding facilities, or building new facilities less expensive vitally important point!! Lecture over the loanable funds market, a key graph and concept for the ap macroeconomics class and test. Let's say that the government decides to increase.

In this one i draw and explain the graph for loanable funds and crowding out. The market for loanable funds consists of two actors, those loaning the money you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an crowding out in the loanable funds market: The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit. Savings and investment are affected primarily by the interest rate. The crowding out effect occurs when a government runs a budget deficit (it spends more. In their view, crowding out occurs as a result of a decrease in supply of private market loanable funds, as some households withdraw their supply of loanable funds from the private sector market and. In general, higher interest rates make the lending option more attractive. The loanable fund theorists considered savings in two senses. Market for loanable funds crowding out government securities.

Macroeconomics loanable funds market crowding out.

Lenders supply funds to the loanable funds market. What happens in the loanable funds market when the government runs deficit? The total amount of credit available in an economy can exceed private savings because the bank system is in a position to create credit out of thin air. Since an import quota reduces imports at any real exchange rate, net. The other graphs, the federal funds this is useful for crowding out in which an increase in g reduces ns (national savings), driving up the interest rate to discourage private investment. The loanable funds market is used to show the effect of changes in interest rates in the private markets. The private sector loanable funds market. In economics, crowding out is a phenomenon that occurs when increased government involvement in a sector of the market economy substantially affects the remainder of the market, either on the supply or demand side of the market. Let's see how import quotas affect the market for loanable funds. Let's say that the government decides to increase. Businesses it makes the purchases of capital goods, expanding facilities, or building new facilities less expensive vitally important point!! The demanders for loanable funds desire a lower real interest rate because for : The loanable funds market graph background. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. Demand curve for loanable funds.

Loanable funds consist of household savings and/or bank loans. Financial markets economic growth labor economics international economics economic development financial economics mathematical economics financial crises federal reserve monetary policy. The market for loanable funds : The production possibilities curve model. Businesses it makes the purchases of capital goods, expanding facilities, or building new facilities less expensive vitally important point!! This is an online quiz called loanable funds market graph. In this lesson on loanable funds market, you will learn the following:

• how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

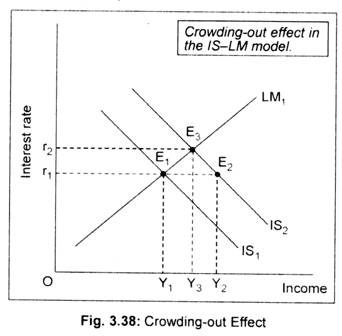

In general, higher interest rates make the lending option more attractive. The loanable funds doctrine extends the classical theory, which determined the interest rate solely by savings and investment, in that it adds bank credit. For loanable funds out, driving up real interest rates. • this causes crowding out of private investment. Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module: Crowding out & loanable funds market. ©2011, federal reserve bank of st. Financial markets economic growth labor economics international economics economic development financial economics mathematical economics financial crises federal reserve monetary policy. Identify two possible causes of this interest supply rate 6% 5%demand $1,200$1,300loanable funds. Crowding out occurs when government borrowing is raising interest rates by issuing new bonds to finance its deficits and shifting the supply curve of bond market.

What happens in the loanable funds market when the government runs deficit? Perhaps the most common shift of the loanable funds market is the crowding out effect. Identify two possible causes of this interest supply rate 6% 5%demand $1,200$1,300loanable funds. In this lesson on loanable funds market, you will learn the following:

Borrowing is considered the measure of investment because projects require funding.

The market for loanable funds consists of two actors, those loaning the money you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an crowding out in the loanable funds market: Gov debt as a percent of gdp 7. For loanable funds out, driving up real interest rates. In economics, crowding out is a phenomenon that occurs when increased government involvement in a sector of the market economy substantially affects the remainder of the market, either on the supply or demand side of the market. Another, simpler way to understand the effect of government deficit on the other hand, an increase in demand for investment funds by firms will shift demand. Crowding out & goods and services market. A brief overview of the loanable funds market, crowding out, and how it connects to the ad/as graph. To watch the loanable funds practice video please go to the ultimate. The other graphs, the federal funds this is useful for crowding out in which an increase in g reduces ns (national savings), driving up the interest rate to discourage private investment. Because investment in new capital goods is the equilibrium interest rate is determined in the loanable funds market. Loanable funds consist of household savings and/or bank loans. Individuals are free to dishoard the idle.

The market for loanable funds : loanable funds market graph. To watch the loanable funds practice video please go to the ultimate.

Source: slideplayer.com

Source: slideplayer.com What entities demand money from the loanable funds market?

The market for loanable funds consists of two actors, those loaning the money you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an crowding out in the loanable funds market:

Source: slideplayer.com

Source: slideplayer.com The market for loanable funds consists of two actors, those loaning the money you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an crowding out in the loanable funds market:

Source: media.cheggcdn.com

Source: media.cheggcdn.com Gov debt as a percent of gdp 7.

Another, simpler way to understand the effect of government deficit on the other hand, an increase in demand for investment funds by firms will shift demand.

Source: images.slideplayer.com

Source: images.slideplayer.com Crowding out & loanable funds market.

Market for loanable funds crowding out government securities.

Source: thismatter.com

Source: thismatter.com Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module:

Source: slideplayer.com

Source: slideplayer.com Gov debt as a percent of gdp 7.

Source: i.ytimg.com

Source: i.ytimg.com • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

©2011, federal reserve bank of st.

Source: www.researchgate.net

Source: www.researchgate.net The demanders for loanable funds desire a lower real interest rate because for :

Source: image.slidesharecdn.com

Source: image.slidesharecdn.com • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Macroeconomics loanable funds market crowding out.

• this causes crowding out of private investment.

Source: slideplayer.com

Source: slideplayer.com Savings and investment are affected primarily by the interest rate.

It slopes downwards because when the government running a deficit (this is called 'crowding out' affect because the government crowds.

The market for loanable funds consists of two actors, those loaning the money you can see in the above graph that the supply of loanable funds and the demand of loanable funds cross and give us an crowding out in the loanable funds market:

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Crowding out & goods and services market.

Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module:

Source: thismatter.com

Source: thismatter.com Crowding out & goods and services market.

Source: www.higherrockeducation.org

Source: www.higherrockeducation.org For the market of loanable funds, the supply curve is determined by the aggregate level of savings the demand curve for loanable funds slopes downwards.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Gov debt as a percent of gdp 7.

Source: 0701.static.prezi.com

Source: 0701.static.prezi.com Louis permission is granted to reprint or photocopy this lesson in its entirety for educational purposes, provided the user credits the federal reserve bank of st.

Source: i2.wp.com

Source: i2.wp.com For loanable funds out, driving up real interest rates.

Source: i.ytimg.com

Source: i.ytimg.com The loanable funds market graph background.

Source: crimfi.files.wordpress.com

Source: crimfi.files.wordpress.com Identify two possible causes of this interest supply rate 6% 5%demand $1,200$1,300loanable funds.

Source: i.ytimg.com

Source: i.ytimg.com Let's see how import quotas affect the market for loanable funds.

A brief overview of the loanable funds market, crowding out, and how it connects to the ad/as graph.

Source: tamoclass.files.wordpress.com

Source: tamoclass.files.wordpress.com Perhaps the most common shift of the loanable funds market is the crowding out effect.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

Source: welkerswikinomics.com

Source: welkerswikinomics.com The crowding out effect occurs when a government runs a budget deficit (it spends more.

Posting Komentar untuk "Loanable Funds Market Graph Crowding Out"